Which of the following investment options you would choose:

Stock A at Rs100 has a 7% chance of dropping below Rs100 in the next five years.

Stock B at Rs200 has a 93% chance of gaining from this price level in the next five years

I was reading an interesting theory which explains the human psychology in making decision as the above question. It is called prospect theory.

The theory tells that while choosing between the two options your mind executed two operations:

- Editing

- Evaluation

In the first, the different choices are ordered following some heuristic so as to let the evaluation phase be more simple.

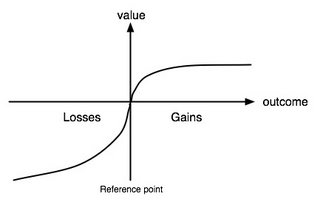

The value function (sketched in the Figure) which passes through this point is S-shaped and, as its asymmetry implies, given the same variation in absolute value, there is a bigger impact of losses than of gains.

This loss aversion refers to the tendency for people to strongly prefer avoiding losses than acquiring gains.

I hope you have seen through the quiz posted above. Both the options indicate same thing. A 93% chance of gaining is equivalent to 7% chance of dropping.

may be you should read a lot about one of other favorite subjects, behavioral economics,

ReplyDeletehttp://en.wikipedia.org/wiki/Behavioral_economics#Key_observations

may be you should read a lot about one of my other favorite subjects, behavioral economics,

ReplyDeletehttp://en.wikipedia.org/wiki/Behavioral_economics#Key_observations